AI Innovation in Digital Banking

Introduction

It’s no secret that in today’s data tsunami, every C-Suite executive (and those that support them) has to have a point of view on how to not just protect, but utilize their customers’ data. It is also a given that the power of machine learning and artificial intelligence must be considered as a way to maximize these efforts. Here at Aerospike we work with many innovators in the Banking and Financial Services industry and ergo have insight as to what is working well.

To that end, we recently teamed up with Forrester Research, who has an eye to the larger trends driving innovation and transformation. As part of BrightTALK’s Digital Transformation in Financial Services summit, we shared a webinar called AI Innovation in Banking. Let us share the highlights below.

The Forrester POV

As mentioned, Forrester has a deep bench of experts who look at how various players are gearing up to handle the Digital Imperative that exploding amounts of data bring. Jost Hopperman is their leading voice in sharing how the data architecture is evolving; so we had him kick off his section.

Jost leads Forrester’s research into the business and technology aspects of banking in the future, particularly banking in 2023 and 2030.

His assertion that “It’s no secret that banks are sitting on treasure troves of data that few of them have successfully exploited.” was matched with Forresters’ own research figures about how many leaders feel they are well set up now (spoiler; it’s low); but conversely and hopefully, how many are confident they will be in good shape by 2024.

In particular; the viewers took great interest in his diagrams of how many financial institutions are transitioning from the traditional banking platforms towards a future-ready digital platform. He talks about how these layers & API’s enable the ability to utilize the large data sets needed for machine learning; with the bespoke AI applications that power a “system of insight.”

The Aerospike POV

Lenley believes that serving data to new real-time applications is a rapidly accelerating requirement for businesses to succeed.

Aerospikes Chief Strategy Officer Lenley Hensarling then kicked off by talking about the most valuable use cases that Financial Services institutions are making with their new and improved data platforms. These include:

More Data for Tighter SLAs

Passive Identity Validation

Risk scoring for anomaly detection

Behavioral Profile Store

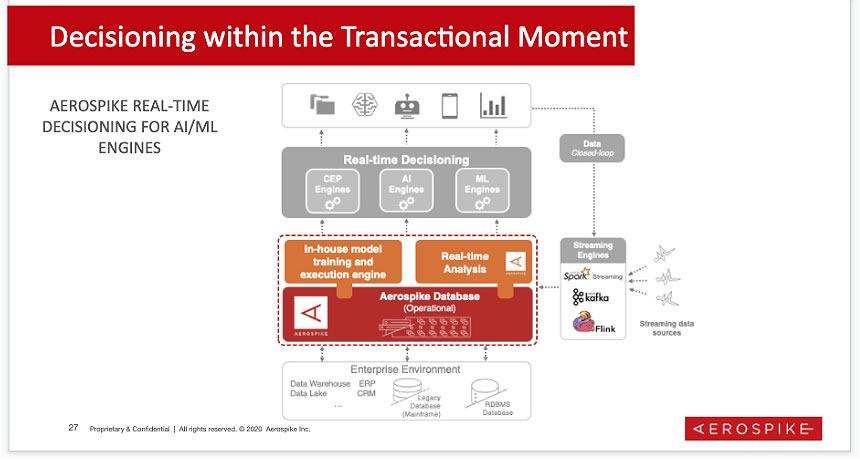

He then looks to the ways that these organizations have augmented, not replaced, their current systems of records; utilizing the most popular connectors for today’s programmers including Spark and Kafka.

He finishes with a vision of what a Real Time Decisioning — Within the Transactional Moment – optimized for ML / AI looks like.

In Conclusion

In a pre-Covid world, there may have been understandable hesitancy for leaders in large Financial Organizations to move with haste to make major architectural decisions.

This is no longer an option in a world where consumers are faced with systems that either delight or frustrate them continually. If you are in a position to explore how you might enhance your ability to leverage the treasure of your customer data, we invite you to watch the full webinar at your earliest convenience.

Watch the Webinar here.