Originally published at https://gomedici.com/why-digital-banking-needs-modern-data-platform

The banking industry’s digital transformation initiatives are primarily divided into digitization drives undertaken by incumbents, and new digital-only banking models such as challenger banks and neobanks. In the latter, instead of going for a banking license, some digital banks elect to take a more direct route of entering the banking business by partnering with traditional banks (over-the-top), thereby creating a symbiotic relationship, beneficial to both parties. For example, Chime, Aspiration, and Tide have partnered with traditional banks. Some pure-play challengers have opted to obtain virtual banking licenses that allow them to run banks without the need for branches, offering services through digital-only channels.

The growth of digital-only banks and neobanks is fueled by changing consumer needs and expectations, dissatisfaction with conventional banks’ service quality, the gig economy, and, from a regulatory point of view, a favorable regulatory environment allowing for their existence. Digital banking can include an over-the-top neobank, a pure-play licensed neobanking player, a digital-only business unit of an established bank, or, sometimes, a traditional bank that’s being transformed into a primarily digital bank. The fundamental idea is to create an experience that’s highly customer and digital-centric in order to deliver banking products and services that leverage more modern banking infrastructure, unlike traditional models.

Digital banking has significant advantages over traditional banking. Due to the digital delivery model, there is a significantly lower operational cost, which can be passed on to customers in the form of better interest rates and lower fees. By not relying upon legacy systems and associated constraints, formulating and rolling out digital-centric products and services with superior customer experience is much easier than with traditional architecture. Strategically, all digital banking outlets tend to choose to start with simple but impactful products targeted at niche customer segments and from there, they then can enhance their product mix over time.

Regardless of the model, digital banking—be it fully virtual or a traditional bank transformed digitally—differentiates itself through personalization, faster service, and a modern experience aligned to the rest of the customer’s digital life. Digital banking approaches strive to understand as well as anticipate customer needs and support them through their financial lives. Quite naturally, managing and processing data intelligently plays a crucial role in gathering the right insights at the right moment, often in real time—customer-centric recommendations and service delivery hinge on these insights. At the same time, management-level strategic and operational decisions on future course and direction require intelligent data processing.

The Data Challenge for Digital Banking

Even as virtual banks are born digital, one must give due credit to traditional banks’ digital transformation drives. Making the hard choice of rearchitecting legacy system landscapes in favor of highly automated and digital-centric ones comes with unique challenges, especially with regard to data management and processing. To render faster, intelligent, and real-time services leveraging the vastly dynamic world of analytics, data silos must be broken down, applications must be rearchitected for open and secure access, and robust data processing must be supported. The vast amount of data that traditional banks have and continue to generate also brings the scalability of new architectures into focus. As more and more financial services become digital, changing consumers’ expectations mandate that banks have a more data-driven business and service delivery model. Though this pursuit is much easier for the more recent digital-only banks, intelligent data processing and management still continues to be the fulcrum of all digital banking architectures.

Consolidating data from multiple sources—internal and external—for an aggregated view, making personalized financial offers, and offering contextual advice is a crucial challenge for banks. The stumbling block here is that most banking systems are built on Relational Database Management Systems (RDBMS), such as IBM DB2, to manage data organized into tables and columns.

Legacy systems and architectures have inherent problems that make them unsuitable for modern digital banking operations that rely heavily on varied data formats and structures.

Common problems include:

Scalability and performance limitations: Source systems are based on legacy technologies that are very hard to scale horizontally.

Hard to maintain: Various products use different transaction processing systems, for example accounts, cards, loans etc., which require different implementations to serve the same functionality. Also, legacy mainframe systems are hard to maintain because they use programming languages, such as COBOL, that have an acute shortage of skilled workforce. Most mainframe programmers have already retired or about to retire without a skilled mainframe workforce to replace them.

Typically batch-oriented: Real-time processing of data is challenging. This makes it hard to compete with the real-time services offered by new-age digital-only banks.

Handling unstructured data: Old systems have limited or no capability of unstructured and polymorphic data handling capabilities.

RDBMS has its advantages—it is considered safer since data is restricted within given parameters. There is always a predefined schema. With RDBMS, it is easy to enforce data integrity rules using foreign constraints and, more importantly, it is ACID-compliant by design. It is this safe and predictable architecture that is also its Achilles heel: it is more difficult to analyze large amounts of data without expending more resources, which points to a scalability issue. More resources in terms of storage, drivers, memory, and CPU power will have to be increased in tandem to scale relational DBs. This is what is referred to as ‘vertical scaling’ or ‘scaling up,’ it requires more capital expenditure and, more often than not, system downtime during the upgrade.

The bulk of back-office processing, compliance, and settlement operations in financial services are managed by mainframe systems due to their indisputable stability. However, when the requirement is to manage very sophisticated, frequent, fast-paced, and complex calculations such as risk and online analytics, there is a need to move these workloads to distributed real-time databases. NoSQL systems can more cost-effectively serve those operational and transactional applications—whereas vertically scaling mainframe systems to handle workloads that they are not designed for adds prohibitively to the overall total cost of ownership (TCO). Additionally, an increasing number of datasets do not work well with relational systems such as social media content. The capability to handle non-tabular data is one of the key reasons for the popularity of NoSQL databases in recent times.

Why NoSQL is the Right Solution

Unlike RDBMS, non-relational DBs are built for Big Data. Since there is no specifically-defined schema built-in, all manner of data with different parameters and formats—structured, semi-structured, and polymorphic—can be managed. While it does not require data to be arranged in rows and columns like SQL, NoSQL (also referred to as ‘Not-Only SQL’) can still be used to store relational data nonetheless. Furthermore, it makes horizontal scaling, also known as ‘scaling out,’ possible. Where SQL would require more resources to scale up, NoSQL architecture is designed to operate in nodes where such nodes collectively form a cluster or a pool with each node in the pool holding partial data. This kind of design makes querying the database faster since all data is immediately available. One node in the cluster can also be brought down for maintenance without putting the whole system offline or affecting other nodes, ensuring an always-on, low-latency service.

NoSQL’s characteristics make it an ideal choice for modern digital banking systems. The design language is quite flexible and allows easy application of unstructured data in the financial system. NoSQL is especially important where there is a requirement for fast access to complex data, something that relational databases are unable to offer efficiently. This also allows other services to be layered on top of core banking systems that simplify the process of scalability since digital banks can be cross-border, cross-national, and serve diverse consumers with multiple needs.

NoSQL can also allow banks to offer other turnkey analytical services besides consumer banking, like accounting, expense management, unique payment solutions, card services, and other business intelligence services. This kind of analytical ability can help banks move faster by analyzing consumer behavior to detect inconsistency hence addressing the issues of security or even preventing fraud.

Case Study: Aerospike

Vendors like Aerospike make the management of NoSQL databases for digital banks easy, eliminating the need to build their services from the ground up but have a readily built engine running which they can plug services into and have a turnkey setup that is easy to start, manage, and control. It also offers a multi-site cluster system that can help neobanks distribute their database for use across multiple locations without lag or expending unnecessary resources. Aerospike provides firms in banking, financial services, technology, and other industries with a resilient NoSQL platform for maintaining an immutable, secure, and auditable transaction history at a low TCO. Using Aerospike’s solutions, digital banks and other FinTech firms can make decisions based on real-time business intelligence data, utilizing AI and ML analytics capability to understand consumer behavior to design and deploy unique solutions.

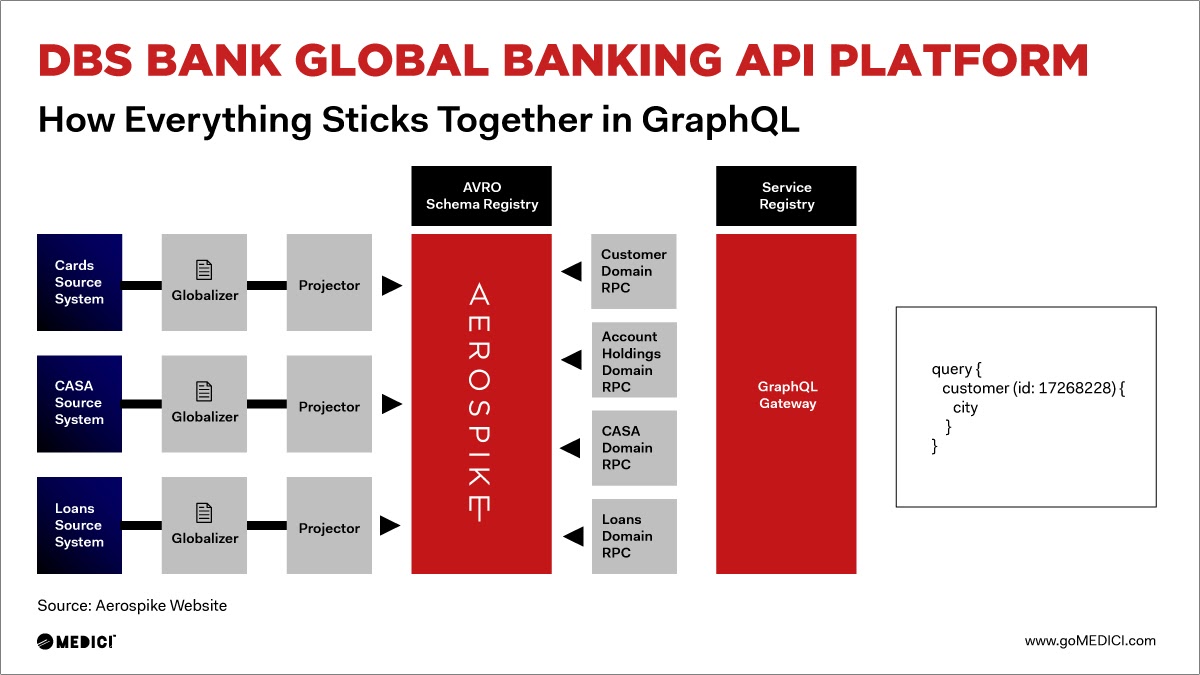

Here is how DBS Bank used Aerospike’s solution in its new Global Banking API platform:

Regulatory and Compliance Fulfillment

It is a well-known fact that the financial services space is one of the most heavily regulated industries. Every year, players in the industry are faced with a barrage of regulatory updates. However, it is also important to note that data has a key role in most of these regulatory changes.

NoSQL applications are widespread from regular usage by digital banks in routine banking operations, such as customer insight, record management, and transaction monitoring.

However, perhaps one of its most beneficial applications is in the area of regulatory compliance.

Be it AML, Basel III, Dodd-Frank, or FATCA, regulations involve processing data from disparate sources that are both internal and external to the organization. There is also the need to continuously update internal procedures based on dynamic regulatory compliance requirements. In all these cases, NoSQL provides a superior solution to traditional relational databases.

Concluding Thoughts

Digital banking requires loosely coupled architectures, with each part functioning based on data gathered and processed in other parts. Although front-end experience layers are isolated from back-end processing systems, storing, managing, processing, and transporting data are critical to overall performance—NoSQL makes this possible. NoSQL offers the ability to shift through large troves of data in real time, thereby helping a digital bank find trends, draw patterns, and provide relevant insight into what would otherwise be incomprehensible pieces of data.

BigTech players like Google, Amazon, Facebook, and Apple have demonstrated how consumer data can be transformed into gold once analyzed, indexed, and monetized. Fast-growing digital banking that adds millions of new customers every month could make a significant change in the financial lives of its customers through best use of data. Therefore, making the right choice concerning databases can be quite crucial for the growth of developing digital banking capabilities.

Keep reading

Mar 10, 2026

AKO 4.2: The evolution of production-grade Aerospike on Kubernetes

Mar 5, 2026

LangGraph for fast, recoverable, and observable agent workflows

Mar 3, 2026

How Aerospike and ScyllaDB behave under production stress

Feb 25, 2026

Introducing absctl: A generational upgrade to Aerospike backup and restore