Originally published at https://gomedici.com/how-nosql-helps-in-financial-crime-detection-fraud-management

In 2019, $181 billion was spent on financial crime compliance by financial services firms, according to a study by LexisNexis Risk Solutions. Broadly speaking, financial crimes include frauds, financial market misconduct, money laundering, terrorist financing, mortgage fraud, racketeering, securities frauds, among others.

While the cost of compliance seems steep, the total cost associated with financial crimes dwarfs these numbers. Consider this: the estimated annual cost of money laundering and associated crimes hovers around $1.4–$3.5 trillion, according to a report by EY. The increasing vulnerabilities to financial crime and fraud combined with intensified cybercrime and malicious hacking have prompted regulators to revise rules constantly and increase policing to tackle it.

Fraud prevention in financial services is a great example of an application that benefits from real-time analytics; it is a very crucial aspect for banks, trading institutions, and payment processors. Failure in these areas results in both financial and reputational losses; both false positives and false negatives can have massive business implications. In this article, we explore the technology requirements and common challenges in effective financial crime detection and fraud management, focusing on NoSQL database capabilities.

Fight Against Financial Crimes is Complex and Costly

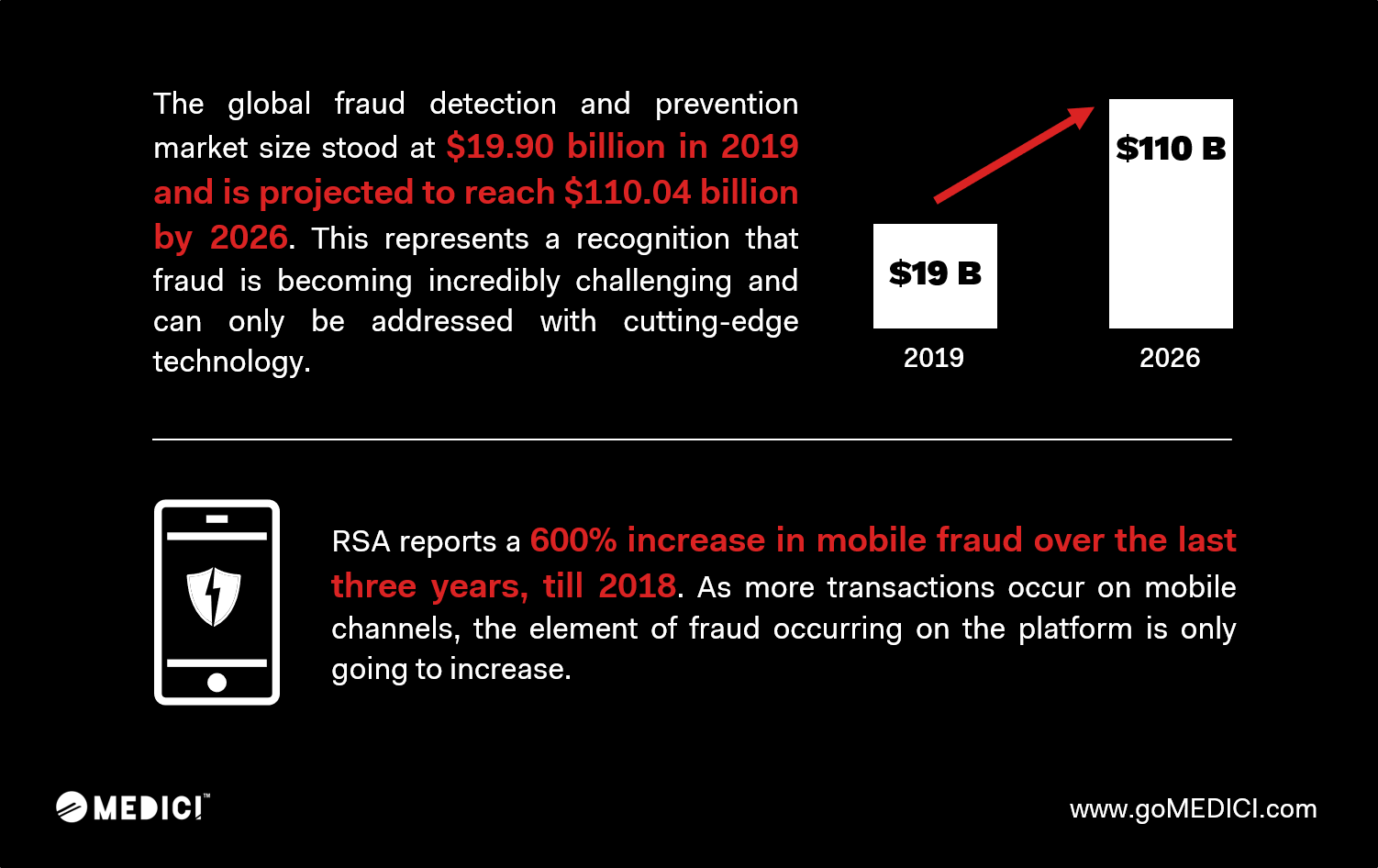

The global fraud detection and prevention market size stood at $19.90 billion in 2019 and is projected to reach $110.04 billion by 2026. This represents a recognition that fraud is becoming incredibly challenging and can only be addressed with cutting-edge technology.

Governments, regulators, and institutions have been expanding the scope of policing to account for illegal trafficking and money laundering, such as economic sanctions. Financial crime contributes to societal ills and threatens the financial stability and inclusion of an economy. Any reluctance in its mitigation and prevention can potentially result in a massive financial loss and loss of confidence by market stakeholders.

Cross-border and domestic exchange of information is imperative to the proper functioning of preventing financial crime like money laundering. At the international level, authorities have been encouraged to drive globally coordinated reform when it comes to information sharing between member states. This is encapsulated in the process of screening clients such as Know Your Customer (KYC) and Customer Due Diligence (CDD). In the context of the Anti-Money Laundering Directive, KYC and CDD process should be compared against sanction lists, and Politically Exposed Persons (PEP) lists should be carried out. This process requires a vast library of information and data on a global scale to establish a framework to identify possible red flags and malicious transactions when dealing with clients.

All this needs to be done without compromising the information security and speed of decision-making. Besides, internal control and risk management within an organization play vital roles when it comes to detecting financial crime as well. Robust internal audit framework, risk assessment, and high-quality financial crime judgment can effectively tackle financial crime and fraud.

Nowadays, banks and financial institutions face serious financial crime challenges that can be reasonably attributed to faulty mitigation and risk management approaches, which resulted in huge penalties, customer dissatisfaction, and loss of reputation. Several challenges, such as increasing complexities of fraud and transactions, require great data protection and real-time detection, which is relatively difficult for conventional solutions.

Fraud prevention also requires real-time decisioning on large and continuously updated datasets. The processing of large amounts of cascading database lookups and immediate identification of anomalies and false positives can prove too taxing for organizations.

Increased governance leads to institutions finding it difficult to manage cross-border & multi-jurisdictional financial crime compliance requirements and ever-growing customer due diligence requirements. Most importantly, the compliance requirements that create a multiplicity of processes and technology solutions that consolidate KYC data and system in a single repository could be a mammoth task for an organization to maintain. They also need to create an effective infrastructure for cross-channel detection, improved data quality, and analytical tools to fight financial crime and fraud.

Due to its data-intensive nature, organizations require the right database infrastructure to tackle these challenges effectively. Without the right database—such as a NoSQL database that provides on-demand access, multivariate data format, and real-time analytics—data cannot be processed efficiently and effectively, ultimately hindering the fight against financial crime. Conventionally, organizations are still sticking with traditional relational databases, but we can observe a growing trend of transition to NoSQL databases.

Why a Traditional Database Is Not the Best Solution for Fraud Detection

Institutions are struggling to manage not only massive volumes of data but also data in various formats. At the core of the problem are data silos that serve as barriers for the flow and communication of information within an organization.

Unlocking the potential of big data is very much dependent on the ability to accommodate new information sources in a more integrated and unified platform and database to gain new insights. Although traditional relational databases and data warehousing technologies promise to bridge the gap, they come at a high cost and simply lack the flexibility needed to keep pace with the dynamics and changes of the market. It became increasingly apparent that a new approach to handling tremendous amounts and data flow is needed—NoSQL comes to the rescue here.

How NoSQL Can Help

Organizations are adopting NoSQL databases as they start to recognize the limitations of traditional relational databases to handle the increasing complexity of data. In previous articles, we have discussed the difference between RDBMS and NoSQL technologies; it is established that NoSQL is preferred when volume, variety, velocity, and valence are differentiating factors for a business.

NoSQL is non-relational and cluster-friendly, which is advantageous in dealing with heterogeneous and humongous volumes of data. Data is stored in a flexible format in NoSQL databases, removing the rigidity of RDBMS.

NoSQL is very useful when it comes to tackling financial crime due to its real-time data analytics, fraud, and risk management features. NoSQL can help streamline and provide a more user-friendly platform, which is critical to customer satisfaction and retention during the client due diligence process within the financial risk management framework.

Through the use of NoSQL databases, graph technologies from players like Neo4j are enabled with the ability to provide a holistic view of the relationships between entities in a financial crime circle and identify real-time sophisticated suspicious connections. The graph approach helps organizations consolidate data into a single view from various data sources like company registries and international watchlists. It can quickly store & query complex datasets, automatically identify graph patterns, streamline the review of suspicious cases, and graph visualization to accelerate investigations. This means that entities or accounts that are seemingly unrelated can be discovered as actually linked and can even be made easy to trace money laundering rings.

Fraud detection methods, such as the smart card management system—a system that manages smart cards that are used as security credentials and electronic identity—are unable to detect fraudulent activities such as identity fraud that span multiple systems and networks. NoSQL can provide access to a schema-agnostic platform to leverage multiple data sources and perform advanced real-time analytics. Through graph-powered investigation, NoSQL is powerful enough to connect the dots and uncover discrepancies in a dataset. This can be used to deliver a holistic view of various entities involved in financial crime and the possible fraudulent link between these entities. Next, the use of NoSQL databases in reference data management, where data can be quickly distributed across geographies, can reduce the risk of regulatory penalties from reporting outdated information.

Niche industry players provide financial crime detection and fraud management capabilities through NoSQL data solutions such as Aerospike, MongoDB, and Amazon DynamoDB.

A Case in Point: Aerospike

Aerospike helps organizations to overcome seemingly impossible data bottlenecks that reduce infrastructure complexity and cost. There are four distinctive value propositions that Aerospike offers to its customers: high availability & reliability, speed at scale, predictable high performance, and low total cost of ownership.

Aerospike provides high availability and a demonstrated uptime of five nines enabled by a highly resilient system with automatic failover, unique cluster management, the Aerospike Smart Client, and geographic replication. Automated load rebalancing & fault-tolerance, background backups, restores & rolling upgrades, and Cross Datacenter Replication (XDR) are all built into the Aerospike solution. With no single point of failure, financial institutions are protected from unplanned downtimes and can be confident that their solutions are always available. Additionally, Aerospike has pioneered a modernized architecture that exploits the superiority of flash device performance, which guarantees speed at scale as a slight delay can result in fraudulent transaction or unacceptable risk exposure position.

To achieve consistently high performance, Aerospike delivers low latencies and high write throughput to enable organizations to build larger-scale applications effortlessly. Real-time decisioning in detecting financial crime requires a multi-component technology stack composed of big data systems and intelligent applications. Aerospike, with its Smart Client Architecture, ensures parallel access to multiple servers in a cluster without a single point of failure and by making sure there is only one network hop to minimize network jitter. Its Hybrid Memory Architecture uses a highly parallel DRAM index to reduce lock contention and potentially unpredictable storage reads. It also reduces the storage system jitter and prevents the effects of unpredictable background processes.

While doing this, Aerospike provides this improved performance at 20% of the total cost ownership (TCO) of first-generation NoSQL and relational databases. Aerospike’s hybrid memory system allows a dramatic reduction in hardware expenses with staff savings due to simplified architecture and built-in automation. Its automated database sharding and system self-management capabilities also minimize the time and manual effort of daily system operations. For one of its clients, a world-famous payments brand, Aerospike delivered 750 ms SLA for fraud prevention for every financial transaction and helped them increase the operational database capacity to handle 60 TB of data and 30 billion objects, thus supporting advanced algorithms for fraud detection.

Concluding Thoughts

Financial crime and fraud are serious business concerns as part of risk management measures in an organization where, if failed, high costs and risk of reputation loss may ensue. NoSQL databases enable real-time analytics on live transactions by removing the latency associated with moving data from operational databases to data warehouses for analytical processing. With NoSQL solutions for financial crime detection and management, such as the one provided by Aerospike, financial institutions have the much-needed technology to combine live transactional streaming data with large amounts of historical data for greater fraud detection accuracy. It is not a matter of if but when the financial service players start wider adoption of new database technologies.

Get a full copy of the white paper to learn more here.

Keep reading

Feb 25, 2026

Introducing absctl: A generational upgrade to Aerospike backup and restore

Feb 24, 2026

Aerospike named Most Innovative Data Platform at the 2026 Tech Innovation CUBEd Awards

Feb 17, 2026

Giving database operators visibility and direct control with dynamic client configurations

Feb 9, 2026

Introducing Aerospike 8.1.1: Safer operations, more control, and better behavior under load