Now is the time to leverage AI to manage risk in corporate banking

The next ten years in corporate banking risk management are expected to bring a greater emphasis on analytics, underscoring the move by institutions to use data and artificial intelligence (AI) to better manage current risks in real-time and make more intelligent predictions about the future.

It has been reported that 15% of a corporate bank’s risk management staff today are dedicated to analytics, and that percentage will jump to 40% by 2025. That’s a significant shift from today’s working model, where 50% of a risk function focuses on risk-related operational processes such as credit administration.

Corporate banking risk management, which aims to limit the risk exposure and asset losses for an institution, often looks at issues such as fraud, investments, payments, credit, debt, assets, and financial markets. Risk managers also consider Value at Risk (VaR), a statistic that quantifies the scope of potential financial losses within a firm over a specific time frame over different economic scenarios. Corporate banks commonly use VaR to determine the probability and extent of capital loss or drawdowns in an institutional portfolio. Banks look to do this across all their securities, which can range from highly liquid equities to less liquid bonds and derivatives, to highly illiquid real estate or private placement funds (e.g., hedge funds, venture capital investments).

For example, the bank might want to know how their portfolio would react if the same economic, political, stock market, or interest rate conditions exist today that were similar to what happened during:

The Internet Bust of 1999-2002 (hint – the Nasdaq fell 75% from its peak by October 2002)

The market reaction to the terrorist activity of 9/11, when the stock markets plunged causing a $1.4 trillion loss in total market value, while gold and oil rallied, or

The Great Recession of 2007-2009, when the Dow Jones Industrial Average (DJIA) fell 777.68 points in intraday trading for its largest one-day drop in history, ultimately losing more than 50% of its value by March 2009.

Unfortunately, when corporate banking risk management falls short, the impact can be enormous and result in billions of dollars in losses. Risk can occur in many parts of the bank, making it difficult for auditors and risk management experts to detect problems early without proper due diligence and stress testing.

For example, a federal judge earlier this year ruled that Citigroup is not entitled to recoup $893 million that it accidentally wired to lenders on behalf of a Citigroup customer, Revlon. Citigroup says it meant to send only a $7.8 million interest loan payment and blamed the foul-up on human error. While Citigroup says that lenders should have known it was a mistake and returned the money, U.S. District Judge Jesse Furman notes that “to believe that Citibank, one of the most sophisticated financial institutions in the world, had made a mistake that had never happened before, to the tune of nearly $1 billion – would have been borderline irrational.”

It was another blow to Citigroup after being hit with a $400 million fine by federal regulators in 2020 for long-term deficiencies and “longstanding failure to establish effective risk management.”

In another example, Credit Suisse lost $5.5 billion when Archegos Capital Management investment fund collapsed after losing big on the collapse of ViacomCBS stock. In the face of shareholder anger, the bank has admitted it failed and was to blame, citing “fundamental failure of management and controls.” Another report chronicled an overworked and underqualified staff as part of the problem, with a system focused on increasing sales and pleasing big clients rather than monitoring risk.

Such losses for Citigroup and Credit Suisse emphasize the need for better corporate bank risk management, especially in the face of growing pressures such as:

Identifying, detecting, and mitigating money-laundering threats.

A greater rush to digitization because of the pandemic.

Compliance with various regulations for domestic and foreign assets and transactions.

Many risk management challenges can be met by adopting artificial intelligence (AI) to identify high-risk areas and provide automation and controls to limit the risk. Using vast amounts of data, AI can help corporate banks strategize for the future, make better real-time decisions, improve risk modeling, provide better monitoring and prevent costly human errors.

Still, AI requires lots of data to learn and then improve and optimize information for an organization. That data also needs to be fast so that decisions can be made in real-time.

Aerospike’s real-time data platform can supply and analyze vast quantities of data, whether it’s for payments, fraud prevention, or investments. It also offers greater consistency to keep information up-to-date at millisecond speeds and extraordinary reliability with 99.999% uptime.

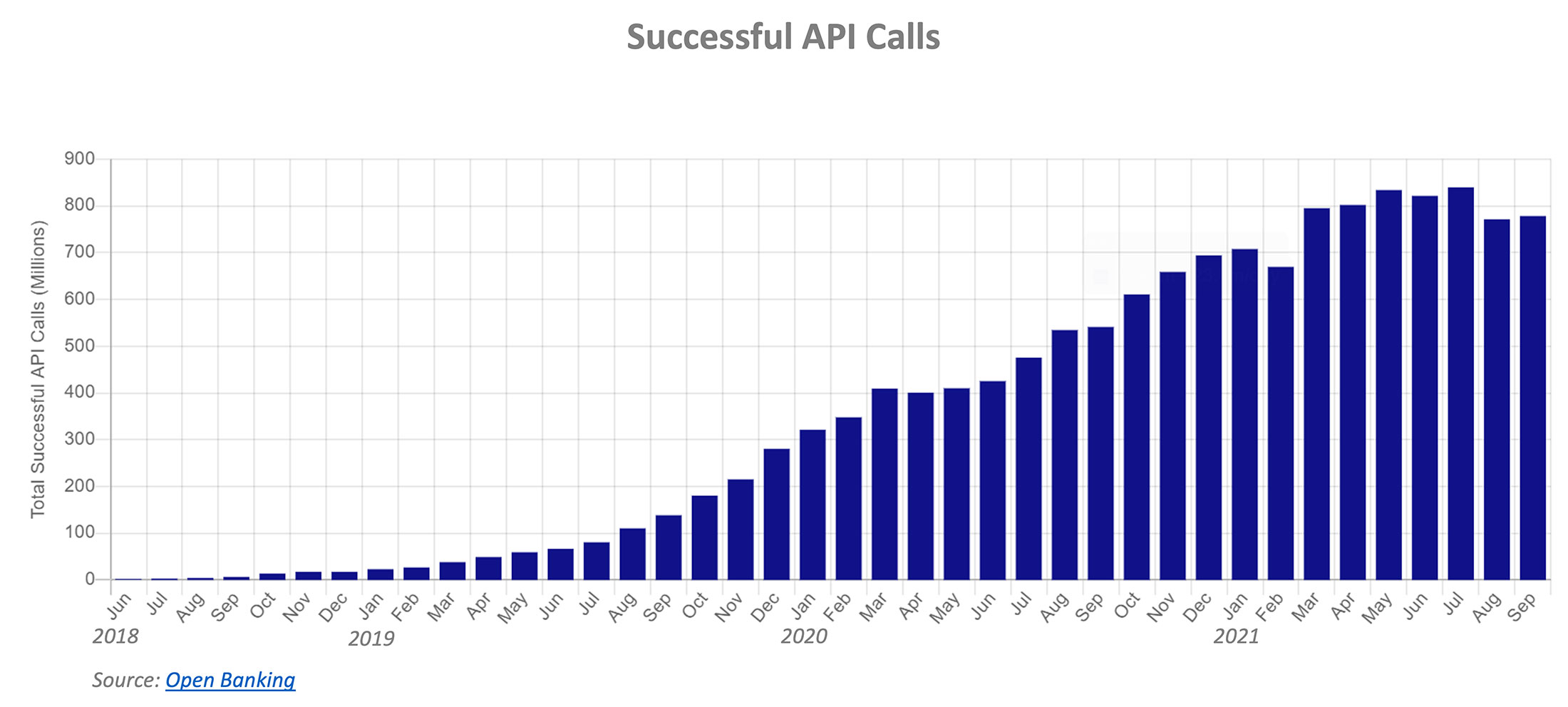

Further, Aerospike’s platform allows banks to consolidate data across application programming interfaces (APIs), which is the foundation for building better services, faster. For example, the Open Banking Implementation Entity reports that API calls jumped from one million a month in May 2018 to more than 66.7 million in June 2019.

In the case of one Aerospike customer, a leading multinational financial services company and one of the top three brokerage firms, it was critical to ensure that account authentication, trade authorization, and compliance/risk controls were handled accurately and in real-time. Aerospike’s ability to handle large amounts of data quickly ensured that this financial services company provided best-in-class responsiveness to customers’ trading activities while remaining in compliance with securities regulations and internal controls. While at the same time ensuring consistent data and performance with scalability and low latency, even during peak trading periods.

According to Mordor Intelligence, the compound annual growth rate for big analytics in the banking market is expected to be nearly 23% from 2021 to 2026. With more corporate banks facing unprecedented worldwide regulatory and market pressures, using a proven real-time platform to handle data quickly, reliably, and consistently will be critical. More importantly, relying on AI and data will help prevent costly human errors and provide greater insight when determining risk.

Learn more about powering your Banking solutions with Aerospike’s real-time data platform. You can also watch our webinar on Blasting Through the 4 Biggest Challenges to Leverage AI in Financial Services for more information.