The real-time data imperative for banking

As banking institutions face a rapidly evolving digital environment, they are being forced to modernize their data infrastructure across front-, middle- and back-office operations – utilizing data as a strategic asset to optimize their business.

The Aerospike real-time data platform sits at the heart of the retail, corporate, and investment banking ecosystem where it:

- Connects and analyzes massive volumes of datasets in real time to understand customers on the deepest level

- Hyper-personalizes the digital experience

- Maximizes your analytics/AI, risk management, and compliance applications

- Ensures the integrity and compliance of every financial transaction.

The Aerospike Real-time Data Platform supplies and analyzes more data, faster to foundational banking applications including mobile banking, payments, customer 360, mobile, fraud prevention, and recommendation engines, enabling more differentiation, control, flexibility, ease of use, and reduced friction.

Front office benefits

Retail and corporate banks

Today’s retail and corporate banking consumers expect an engaging, intelligent digital experience every time they transact with you online.

“We said we’re going to take all of these 350 million customers regardless of which line of business they belong to and create a single repository. It will give us a complete 360-degree view of the customer.”

– Harmeen Mehta, former Global CIO and Head of Digital, Airtel

-

Aerospike helps you:

-

Enable AI-powered online recommendation engines, tailored pricing, and rates, and upsell opportunities with a faster and deeper knowledge of each customer

Enable AI-powered online recommendation engines, tailored pricing, and rates, and upsell opportunities with a faster and deeper knowledge of each customer -

Master fraud detection and reduce false-positive exposure by enabling 10x the number of attributes to be analyzed without increasing customer friction

Master fraud detection and reduce false-positive exposure by enabling 10x the number of attributes to be analyzed without increasing customer friction -

Speed transaction, payment, and response times to improve user experience and engagement

Speed transaction, payment, and response times to improve user experience and engagement -

Gain deeper insight into customer background and activity to lower risk, improve compliance, prevent fraud, and improve opportunities for upselling and cross-selling

Gain deeper insight into customer background and activity to lower risk, improve compliance, prevent fraud, and improve opportunities for upselling and cross-selling -

Predict customer churn before it happens, and take immediate, automated action

Predict customer churn before it happens, and take immediate, automated action

Investment banks

As investment banks go digital, they discover an immense opportunity to use data as a strategic asset to expand their customer bases and provide a more personalized range of services.

-

Aerospike helps you:

-

Speed development and presentation of portfolio research, risk models, and complex investment strategies

Speed development and presentation of portfolio research, risk models, and complex investment strategies -

Empower front-office sales teams with 360-degree customer view, recommendation engines and upsell/cross-sell opportunities

Empower front-office sales teams with 360-degree customer view, recommendation engines and upsell/cross-sell opportunities -

Enable low latency algorithmic trading for stocks, bonds, options, and other financial instruments across multiple exchanges in real-time to ensure the best execution

Enable low latency algorithmic trading for stocks, bonds, options, and other financial instruments across multiple exchanges in real-time to ensure the best execution

Digital banks

Unencumbered by legacy systems and costly physical branches, digital banks can start fresh and re-imagine banking as a mobile-only service. Neobanks, or “challenger banks,” are fintech firms that offer apps, software, and other technologies to streamline mobile and online banking.

Learn more about how Aerospike powers digital banking success in multiple ways.

-

Aerospike helps you:

-

Create a true 360-degree view of your customers by connecting streaming and third-party data sources in real-time with systems of truth to deliver more targeted offers, increase customer satisfaction, ensure a frictionless user experience

Create a true 360-degree view of your customers by connecting streaming and third-party data sources in real-time with systems of truth to deliver more targeted offers, increase customer satisfaction, ensure a frictionless user experience -

Maintain predictable performance as you grow from terabytes to petabytes of data while scaling seamlessly as your user base grows into the tens of millions...all while reducing server footprint by up to 80%

Maintain predictable performance as you grow from terabytes to petabytes of data while scaling seamlessly as your user base grows into the tens of millions...all while reducing server footprint by up to 80%

Middle office benefits

Strengthening middle office operations with a robust data infrastructure gives you a critical differentiator for your banking business, combining unmatched speed and deeper analysis to lower risk and improve decision making.

![]()

“With Aerospike, we were able to dramatically reduce stand-in processing (STIP), data consistency issues, and reduce false positives and false negatives for future transactions.”

– Dheeraj Mudgil, Vice President, Enterprise Fraud Architect, Barclays

-

Aerospike helps you:

-

Link customer portfolio data with the system of record, cost-effectively convert legacy batch systems into real-time, customer-facing solutions in a consumable format with complete visibility into all client account activity.

Link customer portfolio data with the system of record, cost-effectively convert legacy batch systems into real-time, customer-facing solutions in a consumable format with complete visibility into all client account activity. -

Optimize the frequency of AI and ML model training, preparation, tuning, enrichment, and validation to build a high-performance pipeline to feed AI and ML applications.

Optimize the frequency of AI and ML model training, preparation, tuning, enrichment, and validation to build a high-performance pipeline to feed AI and ML applications. -

Leverage AI-powered analysis to accurately measure credit, market, and operational risk.

Leverage AI-powered analysis to accurately measure credit, market, and operational risk. -

Automate real-time risk management, compliance, and liquidity applications to meet regulatory requirements.

Automate real-time risk management, compliance, and liquidity applications to meet regulatory requirements. -

Build a more profitable, data-driven margin lending business with real-time visibility to differentiate your offerings and compete more effectively on margin lending rates and limits.

Build a more profitable, data-driven margin lending business with real-time visibility to differentiate your offerings and compete more effectively on margin lending rates and limits.

Back office benefits

Aerospike’s real-time data architecture strengthens every facet of back-office banking activity, helping you reliably manage accounts, customers and entities; automate clearing/settlement and reconciliation; conduct faster funds administration; manage operational risk and compliance, and minimize fraud exposure from cash management.

“We wanted … support for secondary indexes (and) an architecture that was fully scalable, distributed, shared nothing design. These are (some) of the reasons that we chose Aerospike.”

– Matteo Pelati, SVP, Data and Global APIs Engineering – DBS Bank

-

Aerospike helps you:

-

Scale and speed back-office automated processing or clearing, settlements, reconciliation, ACH and wires, commissions and charges, entitlements and securities, and real-time reporting

Scale and speed back-office automated processing or clearing, settlements, reconciliation, ACH and wires, commissions and charges, entitlements and securities, and real-time reporting -

Ensure adherence to data privacy (e.g., CCPA, GDPR) and compliance mandates ( e.g., CCAR, Dodd-Frank, EMIR), and deliver risk reporting in real-time

Ensure adherence to data privacy (e.g., CCPA, GDPR) and compliance mandates ( e.g., CCAR, Dodd-Frank, EMIR), and deliver risk reporting in real-time -

Provide visibility, transparency to improve real-time interactions between front-, middle- and back-office entities to optimize efficiency and minimize costs

Provide visibility, transparency to improve real-time interactions between front-, middle- and back-office entities to optimize efficiency and minimize costs -

Leverage AI to generate analysis on trade optimization, performance measurement and model attribution, disputes, reconciliation, compliance reports, and trade reports

Leverage AI to generate analysis on trade optimization, performance measurement and model attribution, disputes, reconciliation, compliance reports, and trade reports

Transform your bank with Aerospike’s real-time data platform

Get the latest, what's new with Aerospike?

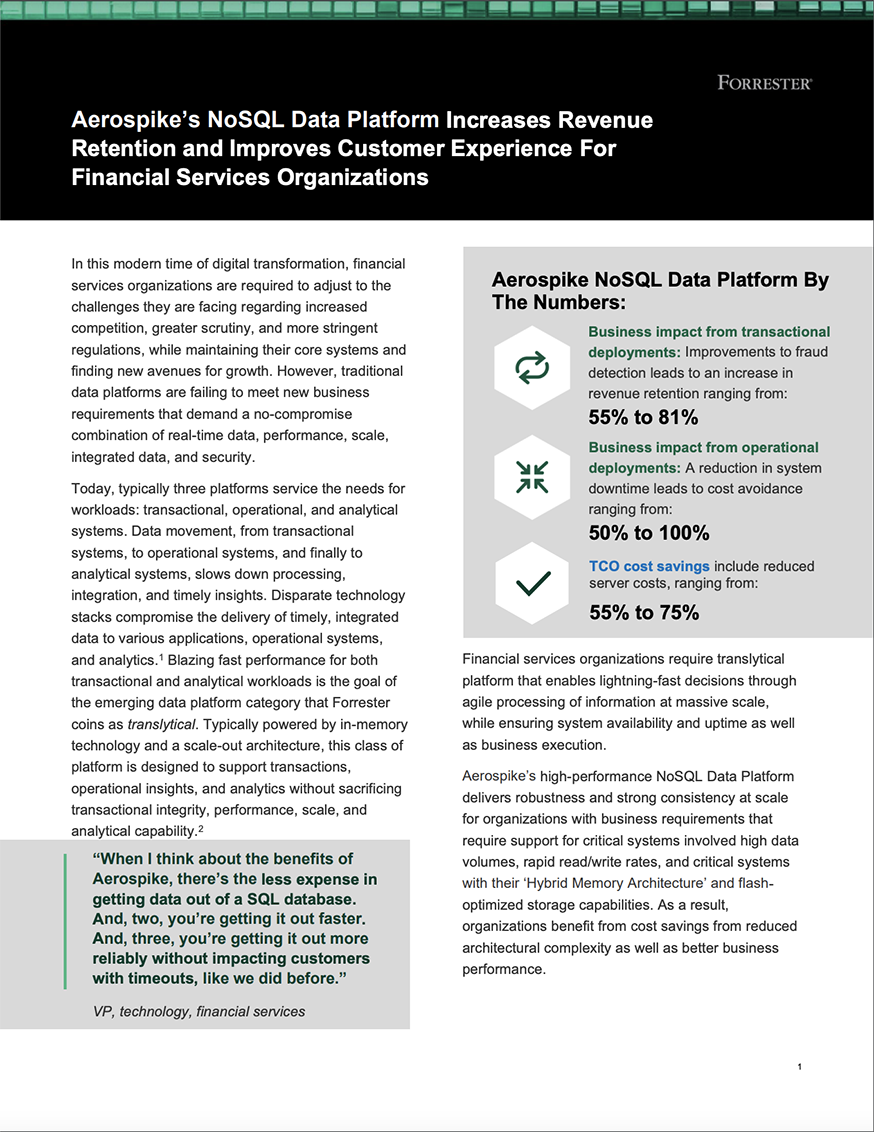

Aerospike’s NoSQL data platform increases revenue retention and improves customer experience for financial services organizations

A study conducted by Forrester Consulting