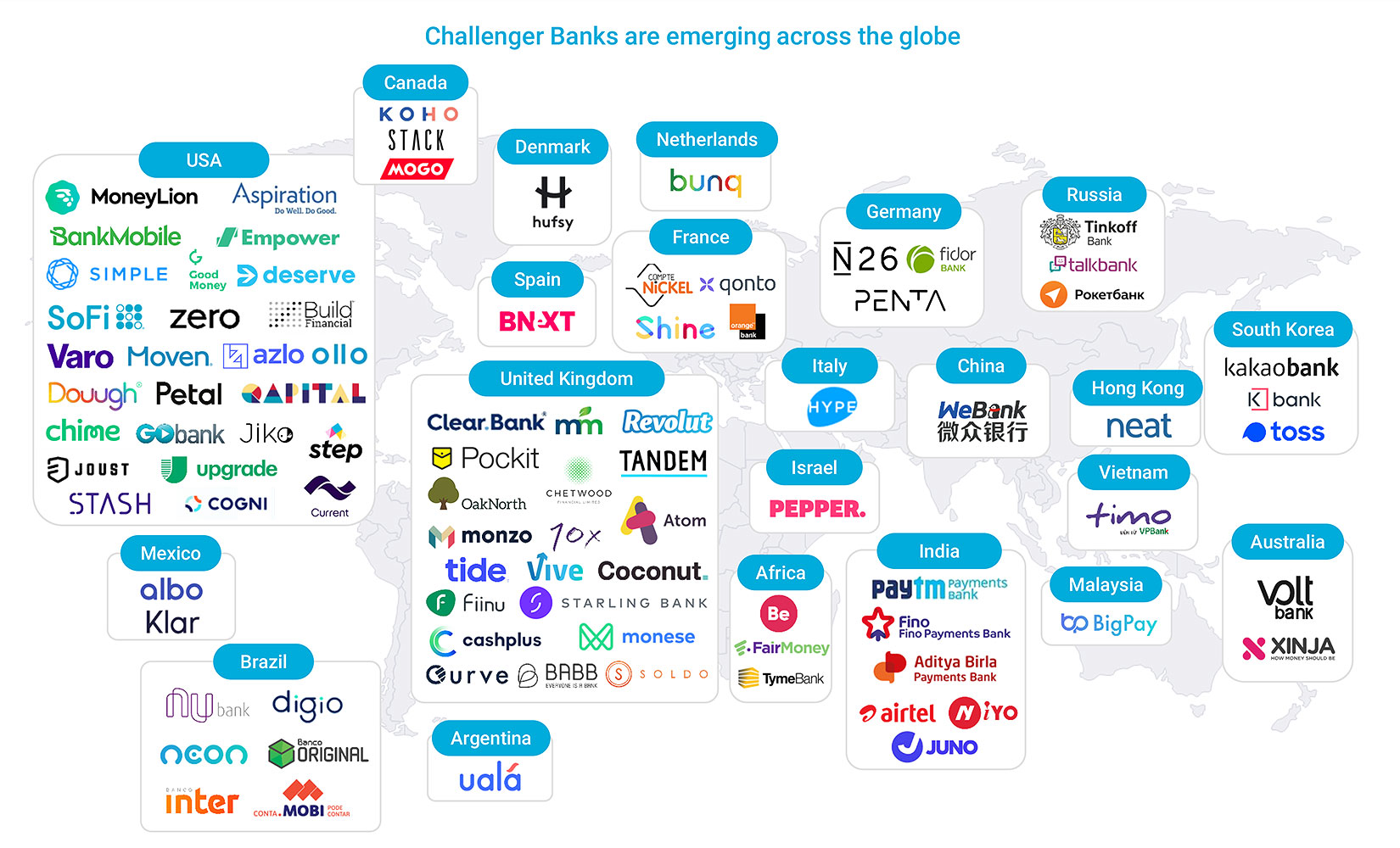

Revolut, Monzo and Starling Bank may not yet be household names, but the rise of such “challenger” banks using technology to gain market share is shaking up the traditional banking industry and leading the once dominant legacy banks to change the way they do business.

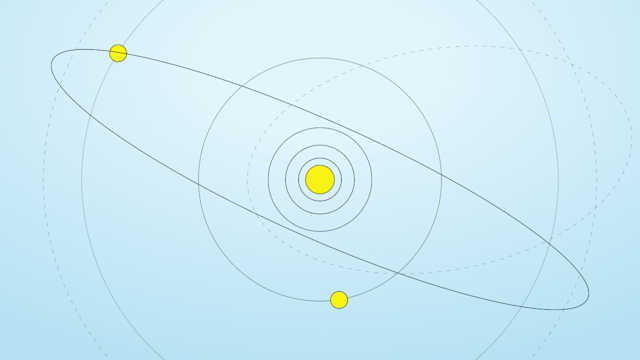

There are now more than 250 challenger or “neobanks” that have been launched globally, with the 20 largest now valued at more than $73 billion and having more than 130 million customers. Cornerstone Advisors reports that almost three million Americans currently identify a fintech organization as their primary checking account provider. These fintechs are being propelled by a large influx of venture capital money, such as Chime, which offers no fee mobile banking services. Chime has received some $2 billion in investment funds since it started in 2013. According to Financial Technology Partners, so far in 2021, there have been 185 fintech financing rounds of $100 million or more, “an unprecedented level”.

Source: FT Partners Fintech Industry Research, January 2020

Apps like Revolut, Monzo and Starling Bank, all based out of the U.K., offer customers online services such as budgeting, credit cards, business accounts – even cryptocurrency services – that have filled the gaps that the more established banks with their legacy infrastructures have failed to provide. Regulations in Europe and the U.K., such as the Open Banking Initiative and the Payments Services Directive (PSD2), have made these online banking services easier to operate as financial data can be shared among institutions with customer approval.

Traditional banking under pressure

In the U.S. challenger banks are seeing a big uptick in customers. Chime has more than 12 million customers, while Current has more than two million. Varo Bank has more than four million customers, and tripled revenue in 13 months. Challenger banks have become more attractive to customers for several reasons: the pandemic has made online banking more attractive and users get faster delivery of stimulus payments from the government; legacy banks took a reputational blow in the 2007-2008 financial crisis; and many neobanks offer ease-of-use, no-fee accounts and early access to funds via banking apps.

Traditional banks are trying to compete, especially at a time when younger consumers are abandoning banks as their primary account holder. For example, JP Morgan Chase has introduced a digital bank in the U.K. that offers a fee-free current account combining money management aspects in addition to cashback rewards. Goldman Sachs is investing £50 million in Starling Bank and launched “Marcus by Goldman Sachs,” in 2016, which is an online bank offering high-yield savings accounts, no fee-personal loans and high-yield and penalty-free certificates of deposit.

So, while it’s clear that these challenger banks are going to continue to innovate and use technology to attract customers and drive new services and products, legacy banks aren’t going to simply cede market share. Legacy banks have long customer relationships and have significant financial resources and talent, which means they are expected to continue to push innovations to attract and retain customers.

Another significant competitive threat to banks are companies outside of financial services, often referred to as ‘non-banks’, who want to offer their customers financial services to complement their core business. Examples include companies such as Amazon, Walmart, IKEA and Mercedes, who are using software to offer customers financial services such as banking, credit and insurance. It’s a cross-selling strategy that relies on the deep data relationship these companies have with customers. For example, earlier this year Walmart hired two senior bankers from Goldman Sachs to lead their emerging financial services business. Their mandate is to offer ‘affordable’ financial services and to monetize their enormous data store.

Delivering better experience, value

All of this is putting enormous pressure on the legacy banks to innovate and expand their digital capabilities. Being able to act on their customer data in real-time is critical for both challenger and legacy banks if they want to offer differentiated, personalized service and products.

In addition to the need for more data access, traditional and challenger banks alike must be able to provide secure transactions with speed and reliability, as well as being able to scale operations easily while containing costs.

With Aerospike’s real-time data platform, companies are able to get more data faster to foundational digital banking applications, including payments, customer 360 and fraud/risk management solutions as well as when feeding recommendation engines and powering the artificial intelligence / machine learning that enables these applications.

Consider how Aerospike’s platform can:

Deliver better customized experiences and services.

Aerospike helped Airtel and Airtel Payments Bank, the former the world’s fourth largest mobile network operator and a mobile commerce company, to create the backbone of it’s Customer 360 engine which understands each customer intelligently and contextually. This engine powers Airtel’s “Digital Brain” that supports a completely customized engagement model. Not only can Airtel mine trillions of records to create this deep learning capability, they also have a dynamic way to store and serve this information with a run rate of more than 25,000 transactions per second and microsecond latency.

BCG reports that personalizing customer interactions can lead to annual revenue increases of 10 percent for banks.

Offer a unified profile.

PhonePe, one of the largest digital payments and financial services firms in India, started at the end of 2015, has done more than 22 billion transactions in that time and offers services such as insurance, mobile payments, mutual funds, atms and more. They laud Aerospike as it gives them a consistent key value store that can be used across the organization to power a real-time unified profile for each customer, one that is able to

scale and grow with PhonePe. Aerospike offers effortless maintenance, and adding or removing nodes is a seamless process that works well with end users and merchants, both online and offline.

Prevent fraud.

With more than 390 million active users, PayPal – who offers payments, money management, and risk management solutions – relies on Aerospike to merge its

fraud management platform and data from customer enrollments, payments, invoicing preferences and profile data so they can process and analyze this data to identify emerging fraud patterns. This is all done in under 200 milliseconds. PayPal has realized a 30x reduction in the number of fraud transactions missed by improving SLA adherence from 98.5% to 99.95%.

Provide instant payment settlement.

Aerospike’s work with a major European bank enabled the institution to secure payments from anywhere in the area within a matter of seconds. The bank has more than 43 million transactions a day, which requires constant availability and results to customers in real time. With Aerospike, they were also able to be within their cost boundaries of €0.0020 per payment.

Improve AI/ML applications.

Digital banks use artificial intelligence (AI) and machine learning (ML) to better understand and engage with their customers. For example, banks can now engage customers with 1:1 marketing by offering products with interest rates, fees and promotions personalized to their individual needs. Fintech is using more AI because it is applicable to so many

useful applications and helps them deal with the huge amounts of data that must be processed precisely. These challenger banks also rely on AI for better risk management; to make more informed decisions; provide greater customer support; detect fraud early and prevent it; and to automate back-end operations such as administrative tasks and data processing. In addition, AI/ML algorithms can help businesses use large data sets to create faster and better predictions of future customer behavior and needs. Aerospike’s platform is designed to ingest large amounts of data in real-time to enable the most demanding AI/ML-based applications.

Challenger banks and legacy banks operate differently, but the goal is the same: to attract and retain customers with highly reliable, secure, and personalized interactions. Constant innovation is required to keep up. These goals can be met both today and in the future with the Aerospike real-time data platform. It enables digital banks to act instantly across billions of transactions while keeping server footprints small, and operate in mixed hybrid environments (e.g., mult-cloud, on-prem), with predictable sub-millisecond performance up to petabyte scale with five-nines uptime with globally distributed, strongly consistent data.

Keep reading

Feb 17, 2026

Giving database operators visibility and direct control with dynamic client configurations

Feb 9, 2026

Introducing Aerospike 8.1.1: Safer operations, more control, and better behavior under load

Feb 9, 2026

How to keep data masking from breaking in production

Feb 5, 2026

Helm charts: A comprehensive guide for Kubernetes application deployment